Bank of Valletta held its 50th Annual General Meeting during which, BOV Chairman Dr Gordon Cordina, and CEO Kenneth Farrugia, together with the Bank’s Directors, met with shareholders to present the BOV Group performance for 2023 and propose several resolutions for approval to the shareholders of the Bank, which included the final gross dividend of €0.1162 per share (representing a gross payment of €67.9 million), consisting of the interim dividend of €0.0462 per share (representing a gross payment of €27.0 million) already paid to shareholders on 6 December 2023 and the dividend proposed of €0.0700 per share (representing a gross payment of €40.9 million). All resolutions proposed for shareholders’ consideration were approved.

The Annual General Meeting also brought the directorship term of Kevin J. Borg and Elizabeth Camilleri to an end, after they chose not to seek re-appointment to the Board. This led to two vacant Non-Executive Director positions, where Dr Christian Bonnici West and Dr Jonathan Spiteri were appointed to the Board. Their appointment is subject to regulatory approval and will become effective from the date of approval.

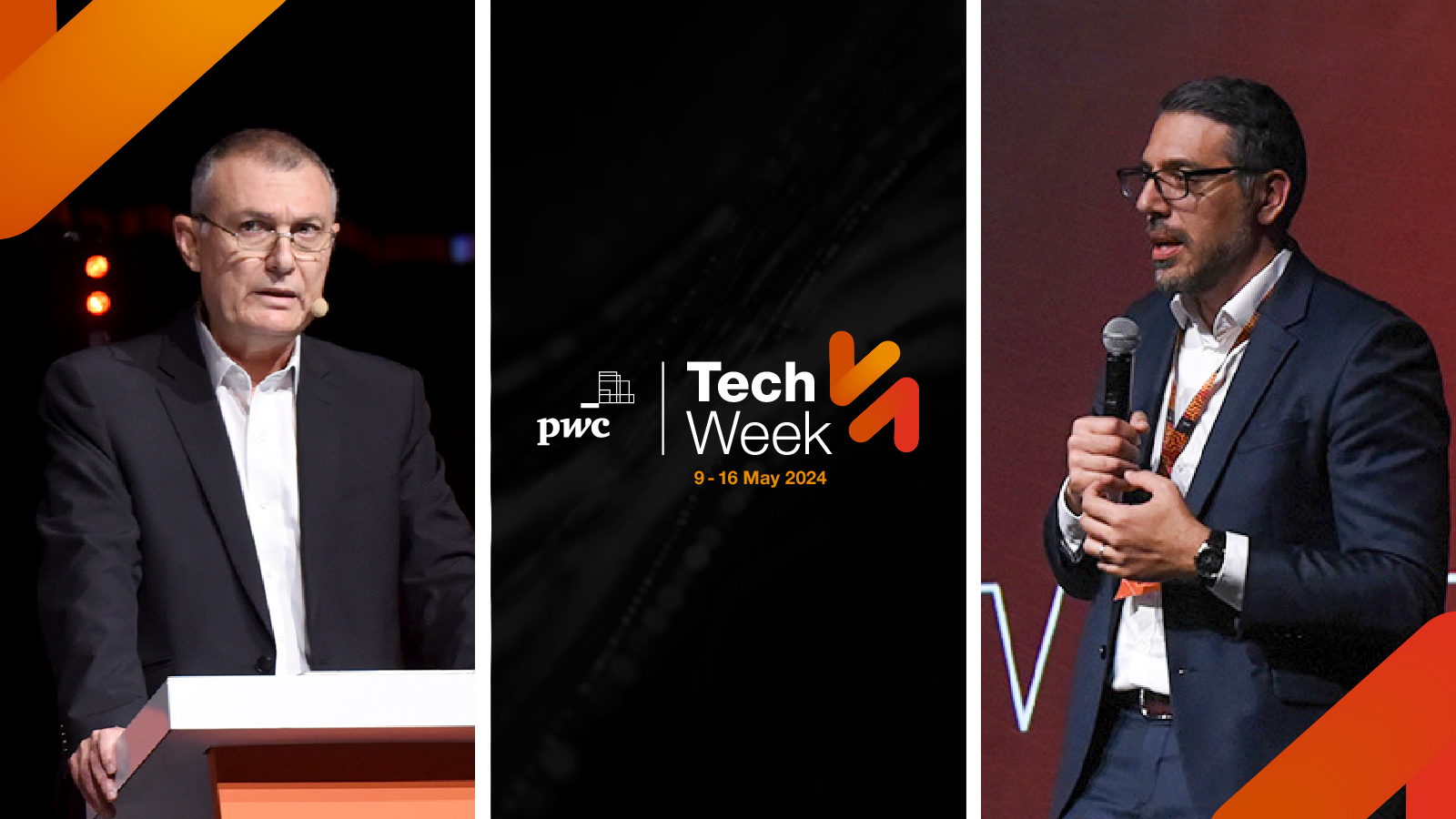

Sustaining our commitment to our shareholders, our clients and Malta – Dr Gordon Cordina

Addressing shareholders during the meeting, Dr Cordina commented that “2023 was a very positive year for the Bank of Valletta Group, which registered healthy profits in a situation of positive interest rates. The Bank’s performance can be seen within the context of an economic scenario that, despite the headwinds of high interest rates, elevated inflation, and uncertainty, saw the Maltese economy continue to grow at a sustained pace”.

Dr Cordina commented on the Bank’s balance sheet, that exceeded €14 billion at the end of 2023. “The Bank’s balance sheet accounts for almost half the total assets of Malta’s core domestic banks. BOV’s market share for 2023 was slightly above 40% with respect to corporate loans and household deposits, and slightly less in the case of home loans. These statistics clearly highlight the systemic importance of BOV, and the crucial role that the Bank plays in sustaining the local economy.

The resumption of a dividend payment, supported by the safety offered by the Bank’s strong capitalisation and liquidity, was also a key accomplishment in 2023. The dividend payout in 2023 was one of the highest dividend distributions paid in recent years. This has been distributed after taking into consideration the Bank’s growth ambition and corresponding capital requirements, affordability, as well as regulatory and shareholder expectations. This structured approach is aimed to ensure the sustainability of dividend payouts in the future and supportive of our commitment to all our stakeholders, including our shareholders, clients, and the economy at large.”

50 Years Shaping Malta’s Economy – Kenneth Farrugia

During his address, CEO Kenneth Farrugia expressed his satisfaction on the remarkable performance registered by the Bank in 2023. “Bank of Valletta’s financial performance was undoubtedly one of the best experienced during its 50-year history, with strong income growth achieved across all core business lines. The increase in interest rates, the strength of our balance sheet, our robust risk management framework, and organic growth in core business lines, were all key enablers of the financial results registered during the year.”

Kenneth Farrugia also referred to the strategic objectives set by the Bank for the period 2024-2026 and commented that several foundational changes are in place to strengthen the Bank’s business and operational model, supporting the key strategic thrusts over the next three years.

One of the areas where BOV has been taking a more prominent role is in the area of ESG, with Kenneth Farrugia citing the Bank’s Corporate Social Responsibility program, improvement in operational efficiencies, as well growth in green commercial and personal lending. “I am pleased to note the leadership position that the Bank is taking on ESG matters. In 2023 we saw 33% of the total facilities sanctioned in loans with green credentials. We have introduced incentives in our credit pricing model to support our customers in their transition to ‘Green’, while on the investment side we have seen 9.3% of total purchased instruments carried out in Sustainable Treasury Investments. Apart from our focus on ESG we continue to focus on our customers. The digitalisation of our operational model remains a high priority and various initiatives are in progress to ensure that across our physical, digital, and hybrid channels, we deliver the service experience expected by our customers.”

In his closing remarks he expressed gratitude to the Bank’s shareholders, employees, valued customers and fellow Board and Executive Committee Members for their commitment, passion, enthusiasm, and unwavering support, as the Bank continues its trajectory towards continued growth and success.

Composition of the new Board

With Mr Kevin J Borg and Ms Elizabeth Camilleri not seeking their re-appointments to the Board of Directors, and with the nomination of Dr Christian Bonnici West and Dr Jonathan Spiteri to occupy the role of Non-Executive Directors, the new Board will be composed as follows:

GORDON CORDINA NON-EXECUTIVE DIRECTOR AND CHAIRMAN

NICOLA ANGELI NON-EXECUTIVE DIRECTOR

CHRISTIAN BONNICI WEST* NON-EXECUTIVE DIRECTOR

DIANE BUGEJA NON-EXECUTIVE DIRECTOR

ANATOLI GRECH EXECUTIVE DIRECTOR

JAMES GRECH NON-EXECUTIVE DIRECTOR

KENNETH FARRUGIA EXECUTIVE DIRECTOR

ANITA MANGION NON-EXECUTIVE DIRECTOR

DEBORAH SCHEMBRI NON-EXECUTIVE DIRECTOR

JONATHAN SPITERI* NON-EXECUTIVE DIRECTOR

ROBERT SUBAN NON-EXECUTIVE DIRECTOR

GODFREY SWAIN NON-EXECUTIVE DIRECTOR

Subject to regulatory approval and the appointment date shall be deemed to be the date of receipt of regulatory approval.